Blog

Main Routes (Domestic and International)

Armenia is a landlocked country with limited access to global markets except through its neighbors. Due to closed borders with Turkey and Azerbaijan, virtually all overland freight must transit via Georgia or Iran.

This reality has made a handful of key corridors vital for Armenia’s domestic connectivity and international trade. Major investments are underway to improve internal routes and develop new transit corridors linking the Persian Gulf to the Black Sea through Armenia. Below we outline Armenia’s main cargo routes – both domestic corridors and the international paths north and south – and how they function as of 2025.

Armenia’s Key Domestic Cargo Corridors

Armenia’s internal road network centers on a north–south axis that connects the country’s main cities and serves as the backbone for both domestic freight and international transit. The flagship project is the North–South Road Corridor (NSRC), a highway upgrade stretching 556 km from Bavra at the Georgian border in the north, through Gyumri and Yerevan, to Meghri at the Iranian border in the south. This corridor follows the route of existing highways (such as the M1 and M2), linking Armenia’s largest urban hub, Yerevan, with secondary cities like Gyumri, Vanadzor, Goris, and Kapan.

Once completed, the North–South highway will allow faster and safer truck movement across Armenia – for example, new tunnel and bypass constructions in the southern section (Kajaran–Agarak) will shorten the Iran-to-Yerevan journey by 54 km and save up to two hours. The goal is to double average road speeds (from ~50 to 100 km/h) on this corridor, boosting efficiency for domestic freight and transit traffic alike.

Other important domestic routes branch off this north–south axis. For instance, the M1 highway westward from Yerevan to Gyumri (Armenia’s second city) is a key freight corridor, recently widened in sections as part of the NSRC program (e.g. 41 km Ashtarak–Talin and 46 km Talin–Gyumri upgrades). Gyumri itself serves as a logistics hub for the Shirak region and a gateway to Georgia.

The Yerevan–Vanadzor route (via Sevan/Dilijan or an alternate via Aparan/Spitak) connects central Armenia to the northeast and is used to reach the Georgian border at Bagratashen.

In the south, the Yerevan–Goris–Meghri road (part of M2 highway) winds through mountains to Armenia’s sole frontier with Iran, carrying both domestic traffic to Syunik province and international freight. Yerevan, located centrally, naturally functions as the primary distribution hub – most import cargoes are trucked to warehouses around Yerevan before being forwarded to other regions. Meanwhile, improved road links like the Lake Sevan bypass and Dilijan tunnel (designs for major renovations at the Dilijan and Pushkin tunnels are in progress) help streamline internal east–west flows.

Although Armenia’s rail network exists (operated by South Caucasus Railway) and parallels some of these routes – for example, a rail line runs Yerevan–Gyumri–Vanadzor up to the Georgian border – rail cargo volume is much lower than road haulage. The railways suffered from post-Soviet route closures and now mainly handle bulk items domestically, since international rail links beyond Georgia are severed (no active rail to Iran or direct rail to Russia due to regional conflicts).

International Routes via Georgia (Northern Corridors)

Georgia is Armenia’s primary transit gateway for international cargo. The Georgian route carries freight northward from Armenia to the Black Sea and to Russia (and by extension, the Eurasian Economic Union). The most heavily used road is the M-4/M-1 highway from Yerevan to Bagratashen–Sadakhlo, the main Armenian-Georgian border crossing in the northeast. After crossing into Georgia, trucks continue via Marneuli to Tbilisi and onward to two key destinations:

- Westward to Poti/Batumi (Black Sea ports): Many cargoes, especially those destined for Europe or overseas markets, are hauled to Georgian ports. From Poti or Batumi, they are loaded onto ferries or ships to reach Ukraine, Bulgaria (Varna, Burgas), or other Black Sea and Mediterranean ports. This makes Georgia a crucial link for Armenian containerized and bulk exports (like minerals) headed to the EU or beyond.

- Northward to Russia via Lars: The only land route to Russia from Armenia runs through Georgia’s Kazbegi (Stepantsminda) checkpoint to Russia’s Verkhny Lars checkpoint in the Caucasus Mountains. This mountainous road (the Georgian Military Highway) is a strategic artery for Armenian trade with the Eurasian Economic Union (EAEU) countries. Over 40% of all trucks using Georgia’s transit roads in 2024 were Armenian carriers, reflecting how dominant this route is for Armenian exports. In the first half of 2024 alone, about 100,000 Armenian trucks (out of 249,400 total) passed through Georgia.

International Routes via Iran (Southern Corridor)

The second critical route for Armenian cargo is the southern corridor via Iran. Armenia shares a 35 km border with Iran at Meghri (Syunik province), where the Meghri–Nordooz border gate serves as Armenia’s door to the Middle East. A highway bridge and customs post at Meghri connect to Iran’s road network, enabling freight to flow between Yerevan and Iranian cities (Tabriz, Tehran, and beyond). This Armenia–Iran highway is part of Asian Highway 82 and is being upgraded; a new bypass around Meghri city and a 360 m tunnel are under construction to improve the steep route near the border. Once complete, the improved Meghri section (and a future 8.6 km Kajaran tunnel) will significantly ease trucking through the Zangezur mountains, making Iran-bound transport faster and safer.

Trade with Iran has grown, making this route increasingly busy. By 2023, bilateral trade was around $690 million, though heavily imbalanced – about 84% of it was Iranian exports to Armenia. Key Iranian goods like oil products, steel, cement, and produce move by road through Meghri into Armenia. For Armenia, Iran also represents a gateway to seaports. Armenian freight forwarders can send cargo by road to Iran’s southern ports on the Persian Gulf (such as Bandar Abbas in the Gulf or Chabahar on the Gulf of Oman) to access shipping lines to Asia and India. In fact, Armenia, Iran, and India have agreed to launch a trade route from Mumbai to Armenia via Chabahar port by 2024. This route would see goods shipped by sea from India to Chabahar, then overland through Iran to Armenia, and onward to Georgia and Europe – essentially forming a “Persian Gulf–Black Sea” multimodal corridor. Such developments aim to diversify Armenia’s transit options, reducing sole reliance on the Georgian route and leveraging Iran’s transport infrastructure.

New Corridor Developments and Logistics Hubs

Both the Georgian and Iranian routes are undergoing upgrades and new corridor initiatives that will shape Armenia’s cargo landscape:

- North–South Road Corridor Project: This Armenia-funded (with ADB, EBRD, etc.) program, mentioned earlier, is crucial for seamless connectivity between Iran and Georgia through Armenia. By creating a continuous high-quality highway from Agarak/Meghri (Iran border) to Bavra (Georgia border), it will facilitate year-round transit. The project (estimated cost $3.5 billion) is being built in phases. Northern sections near Yerevan and towards Gyumri are largely completed or under construction, and now the most complex southern segments (like Sisian–Kajaran with a 9 km tunnel) are underway. When finished, this corridor will link up with Georgia’s roads to provide Armenia a robust highway to the Black Sea. In essence, it upgrades Armenia’s domestic leg of international transit routes (sometimes dubbed part of the “International North–South Transport Corridor” (INSTC), a broader project to connect India to Russia). Even now, partial improvements on this route have lowered travel times internally, and further works are ongoing in 2025.

- Persian Gulf–Black Sea Corridor: Armenia is actively supporting the creation of a multinational transport corridor from the Persian Gulf to the Black Sea, which complements the North–South highway. This concept, championed by Iran and Armenia (with interest from India, Georgia, Bulgaria, and Greece), envisions seamless multimodal transport from the Gulf to Europe. As described by Iran’s plans and recent agreements, the corridor starts at Iranian ports (Bandar Abbas or Chabahar on the Gulf) → goes overland through Iran → enters Armenia (the Meghri/Yerevan route) → then reaches Georgian Black Sea ports (Poti/Batumi) for ferry to Bulgaria/Greece and on to Europe. It explicitly bypasses Azerbaijan, focusing on Armenia as the South Caucasus link. In March 2023, Armenia’s foreign minister proposed this route to India as an alternative to routes via Azerbaijan. By 2025, Armenia, Iran, and India have reaffirmed their commitment to operationalize this corridor. Successful implementation would mean more international freight (for example, India–Europe shipments) transiting Armenia, turning it into a true transit hub rather than an end-point.

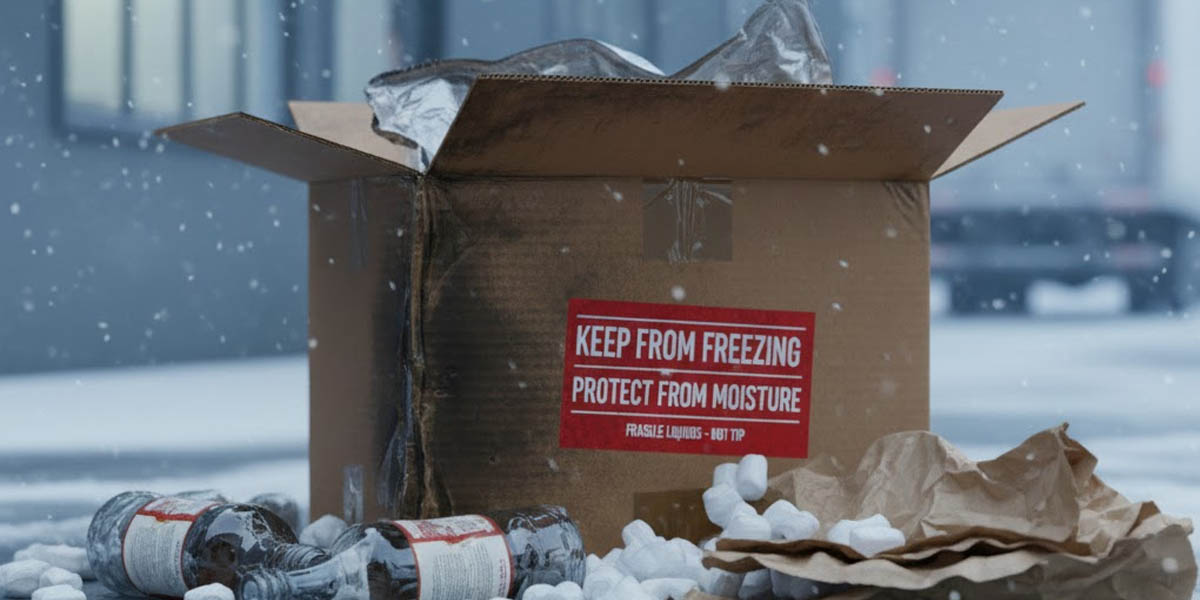

- Logistics Hubs and Facilities: Within Armenia, certain towns are positioning as logistics hubs on these corridors. Yerevan is home to Zvartnots International Airport, which handles air cargo (for high-value or urgent freight, e.g. electronics or perishables shipped by air). There is also an air cargo hub project and a free economic zone near the airport focusing on logistics. Gyumri has a rail freight yard and a free economic zone (focused on technology but with potential for logistics given its proximity to Turkey and Georgia). Meghri on the Iran border hosts a Free Economic Zone intended to facilitate transit trade and light assembly of goods coming from Iran. Additionally, modern customs facilities at Bagratashen, Bavra, and Gogavan (north) and at Meghri (south) now allow speedier processing of trucks – an important factor in avoiding border bottlenecks.

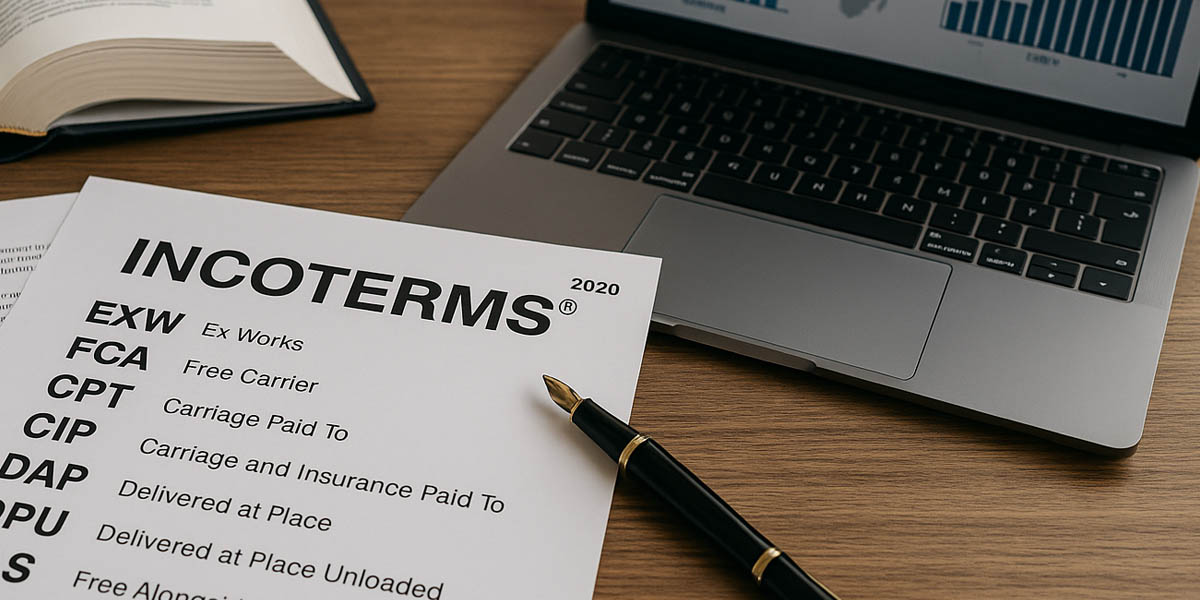

Armenia’s adoption of the e-CMR electronic consignment note in 2024 (joining the UN e-CMR protocol) is another logistical improvement, enabling paperless and faster customs clearance for international road shipments. All these efforts – infrastructure upgrades, new corridor agreements, and digital process reforms – are geared toward leveraging Armenia’s strategic location and overcoming its landlocked constraints.